HRTech

What's your theory? Applying the Value Lab to HRTECH.

I'm sitting in a cafe in Florence writing this. 500 years ago Florence was the centre of so much remarkable innovation. It also has inspired me to write a blog post.

I'm sitting in a cafe in Florence writing this. 500 years ago Florence was the centre of so much remarkable innovation. It also has inspired me to write a blog post.

As you all know by now, I spent a good bit of 2021 studying strategy and innovation at Oxford. One of my goals for 2022 is to apply the frameworks and models to my own business and especially with my clients. Tushman's "explore and exploit" has been helpful with large HRTECH vendor clients looking at the difficult second album problem, Santos's work on category creation has been really useful too. S-Curve theory has shifted how I think about technical debt.

The course has changed how I think about strategy and innovation. While I had hoped to spend several weeks over the year on campus, and zoom fatigue did reduce the fun, the investment has been well worth it. I have made new friends too. I suspect this will not be my last course at Saïd.

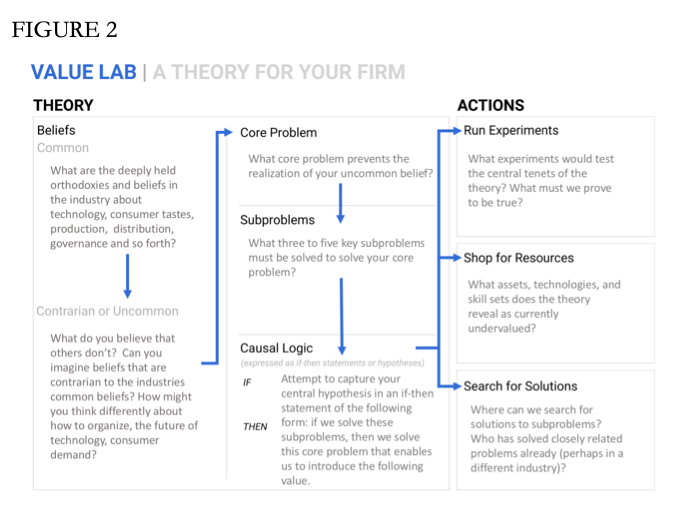

A few weeks ago I was reading through the research of Teppo Felin, one of the professors on the course. He has since moved to Utah but remains close to the Oxford Faculty. One paper jumped out at me, and I immediately wanted to apply it with my clients, especially those early-stage companies seeking market-fit. You can read the paper via SSRN here.

"Theories operate like a flashlight, illuminating paths to value that otherwise remain unseen. Having this flashlight helps managers and entrepreneurs avoid the “streetlight effect”—the human tendency to look for things of value only where the light already shines.

Triggered by the paper, over the last week or so I have been asking clients a really simple question.

what do you believe that (almost) no one else believes?

Together with colleagues Alfonso Gambardella and Todd Zenger, I think Felin has created something rather special. They have done a bunch of research, and they show that

..Those who were taught to compose a theory of value—before setting out to experiment and act—attained significantly higher performance. Their ventures generated more revenue. The companies were also more likely to productively pivot their businesses: correctly and more confidently interpreting the results of their experiments to refine their path forward. They were also more likely to simply exit— again, more quickly and confidently recognizing a flawed theory. Across the board, all evidence pointed to substantially better strategic outcomes when starting with a theory

Over the next few months, I'm going to work on systematically applying the Value Lab ideas with my clients. I'm expecting that it will create a lasting impact, and help them think differently about what they are building.

For clients wanting to be part of this experiment, just drop me a note. I'm thinking it will also be very useful in product due diligence.

I'm in touch with Teppo, and I'll keep him posted on what I learn from applying this.